Child Asset Builder

LEAVING A GENERATIONAL LEGACY FOR YOUR CHILD OR GRANDCHILD

The Magic of Compound Interest

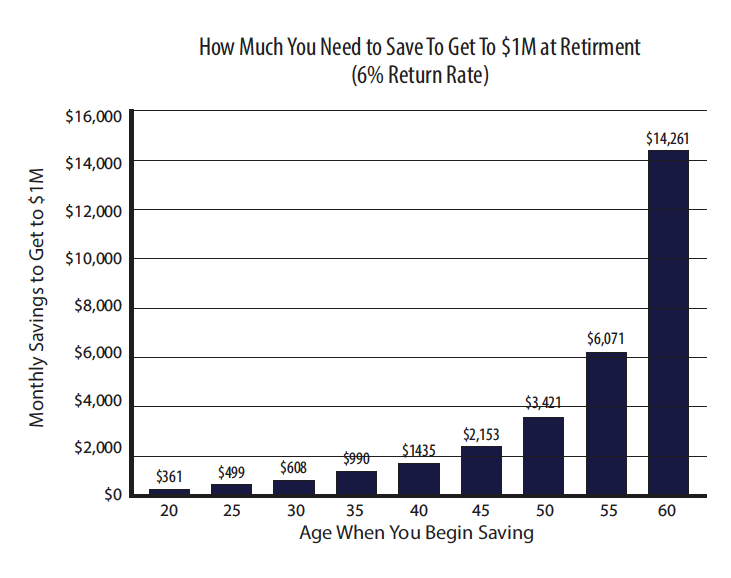

What if you could use the magic of compound interest for decades (i.e., a child policy), yet never pay taxes above basis because you take distributions as a loan?

As a parent or grandparent, you can leave a legacy by using the magic of compound interest.

Request the Child Asset Builder!

The Magic of Compound Interest Combined With Time

Add tax-free distribution with flexibility and you have a Child Asset Builder!

Compound Interest + Time

+ Tax-Free Distributions With Flexibility

= Child Asset Builder

Remember, compound interest is the addition of interest to the principal sum of a deposit. In other words, interest on top of interest. As the years go by, this method of accruement can develop into a sizable amount of money. This is great, but the problem is that interest is always taxable when you take a distribution.